Last summer, Fidelity Investments released the results of its College Savings Indicator study showing that 77% of parent respondents agree that the value of a college education is worth the cost, but 93% are concerned about rising college costs. While the report reads a bit like a pamphlet for a 529 college savings plan, Fidelity hired an independent research firm to conduct the study, and the research question has merit.

It is important to consider how these key influencers think about the cost of college. The Eduventures research confirms that cost is on many parents’ minds, especially the ones we would least expect.

The Eduventures Prospective Parent Research™ also highlights concerns around the cost of college. In 2025, half of all parents wonder what it will really cost to attend college (the top question on parents’ minds), three-quarters have already discussed cost with their child, and 59% percent have a strong preference for their child’s college choice based on cost.

And yes, 79% of parents believe that a college degree will be “very” or “extremely” valuable for their child’s future success. College is worth it, but cost is a decision factor.

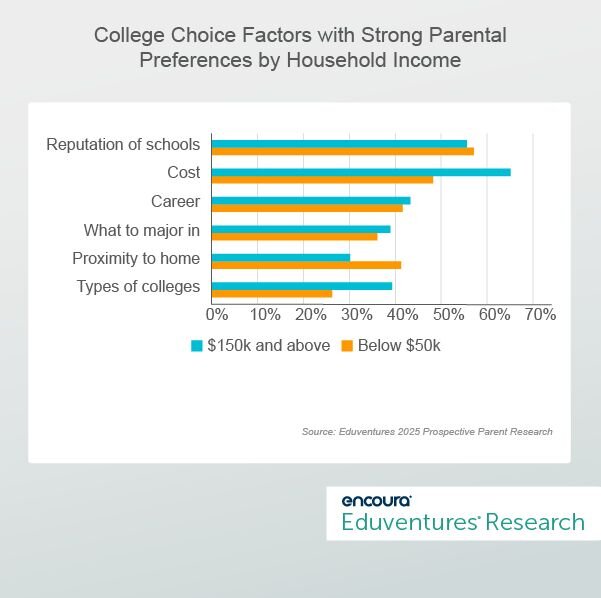

Paradoxically, while we would expect that cost-driven college preferences are even stronger among parents with lower household incomes, these parents show a stronger focus on reputation. Figure 1 shows the top six preferences driving college considerations among parents.

Figure 1

Counterintuitively, Figure 1 shows that parents who report a household income of less than $50,000 have a stronger preference for colleges based on reputation than cost, while those reporting a household income of $150,000 and above show the reverse. The higher earning parent group also shows the strongest preference for the type of college.

Why is it that parents from low-income households seem to care less about cost and institutional type—which is also a strong determinant of price—than their higher-earning counterparts? The only cost-related factor for which parents with lower incomes show a relatively stronger preference is proximity to home, which can affect auxiliary costs like housing and transportation.

To understand this paradox, we need to understand how parents expect to pay for their child’s education. Notably, only 42% of parents with lower incomes expect to be able to make a financial contribution to their child’s college education compared to 73% of parents with higher incomes. The median limit of that contribution for one year’s worth of tuition, room, and board is $10,000 for low-income families and $25,000 for high-income families.

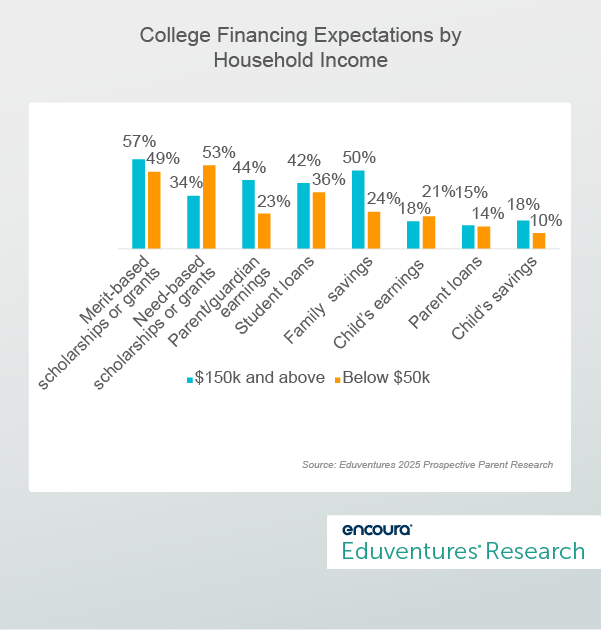

Figure 2 sheds light on how low- and high-income segments expect to pay for college.

Figure 2

Most parents, regardless of income, believe that their child will finance at least some portion of their college education through scholarships and grants. But families with higher household incomes are, of course, better prepared to fill the gap. They are much more likely to fall back on savings or use current earnings. Even student loan expectations are somewhat higher among the higher-income band, though student loans are the third-highest financing expectation for low-income households after need-based and merit-based scholarships and grants.

Parents in higher-income households expect to contribute more of their own earnings and savings to their child’s college education and may therefore feel more strongly about which colleges are worth the investment.

Parents in low-income households put more responsibility for paying for college on their child. The message in low-income families seems clear: you can go to college – if you get scholarships or take on loans.

These parents are less likely to have a personal preference for which institution their child should attend based on cost or institutional type. If the student is on the hook to pay, the student is also the one who needs to find an affordable option.

It is not surprising that parents in low-income households more often say they believe their child is most likely to attend an in-state, public institution (74%) compared to parents in higher-income households (62%). To many students and families in low-income households, the in-state sticker price at the local public college or university may make it seem like the most affordable option.

Scholarship expectations, however, still remain high among these parents: 49% of parents in low-income households who believe their child will attend an in-state public institution expect this child will receive merit scholarships and 61% bank on need-based grants.

This reveals the fundamental pressures students from low-income households feel when it comes to college. The question is not whether college is worth it, but rather, is it feasible?

College needs to be affordable. For prospective students who can’t count on financial support from their parents, even a strong value proposition does not shift the needle unless it is accompanied by substantial grants and scholarships. That’s why, when it comes to understanding financial aid, students primarily want to know what their scholarship options are.

The Bottom Line

The Eduventures research confirms Fidelity’s findings that parents believe a college education is valuable. But that does not mean all parents are willing or able to make this investment for their child. Most parents hope for scholarships and grants—a coveted resource—but for some families, scholarships and grants determine whether the student will attend college at all.

Resources allocated to financial aid, however, are limited. What can institutions do to address affordability when increasing the discount rate is not an option?

- Educate parents about financial aid and college ROI. Parents—regardless of their financial means—may not fully understand college cost and how to finance it. Non-renewable scholarships, additional costs not covered by financial aid, and a general lack of knowledge about financial aid eligibility may blindside families, leading to melt, attrition, and college choices based on misinformed assumptions. Top-of-funnel parent communication addressing the thorny issue of college cost can help influence choice before critical points like application and enrollment choice.

- Offer different educational options for different budgets. If a traditional four-year degree is out of the price range for many prospective families in your market, what alternatives can you offer? Some institutions started thinking outside the box with initiatives like guaranteed pricing, three-year bachelor’s degrees, or a greater focus on degree or curriculum alignment with labor market needs. Now is the time to get creative with pricing or educational offers to expand your audience amid demographic changes.

Eduventures Summit – higher education's premier thought leadership event – is just one month away. Passed are limited – secure your spot today!