The Online Program Management (OPM) industry has weathered considerable criticism from policymakers and watchdogs in recent years, accused of misleading students, pursuing growth at all costs, and price gouging. Some companies have not survived, while others are leaner and diversified.

The term “OPM” still carries a stigma, one that makes some faculty and administrators wary of outsourcing. Yet online remains a viable and necessary way to grow enrollment. Ignoring the online market is not an option for many schools.

Perhaps the OPM sector needs a reset. By reframing OPMs through a human-centered lens, focused less on services and business models and more on students and faculty, there is potential to move beyond old perceptions and appeal to schools again.

OPM Market Recap

For those who haven’t been closely following these companies in recent years, the Biden Administration’s Department of Education had threatened to (but did not) revoke the bundled service exception to the incentive compensation ban. But some states have curtailed or regulated OPM partnerships.

Minnesota, for example, banned tuition-sharing OPM partnerships that bundle marketing and recruitment, while Ohio now requires institutions to disclose OPM contracts publicly and ensure transparency in how OPM staff members interact with students.

A coalition of non-profits and think tanks has created a “State Legislative Toolkit” to restrict OPMs at the state level. One group in the coalition supports lawsuits against institutions using OPM providers.

Many OPMs are adopting fee-for-service models and elevating technology as the core of their offerings. Others have formed platforms, following the edX model. Here are some examples:

- The Australian branch of Keypath Education launched an “AI-enabled short course platform” for business professionals.

- Following the rise of Guild and InStride, many OPMs now link employers with institutions to meet workforce learning goals and cut digital marketing costs.

- Risepoint (formerly Academic Partnerships and Wiley University Services) announced multiple new and expanded partnerships, consolidating its top market position.

- Meanwhile, 2U, for years the OPM market leader, has been quietly emerging from bankruptcy and managing lawsuits.

With a diminished OPM market and growing expectations for institutions to build online capacity in-house: Do institutions still need these companies?

Most Institutions Are Not Considering OPMs

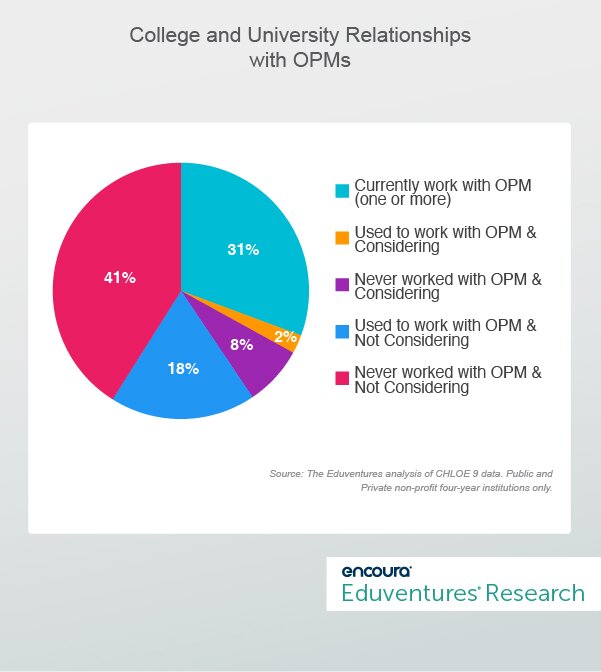

In CHLOE 9, just 10% of chief online officers (COLOs) at four-year schools indicated they were considering an OPM partnership (Figure 1), while a majority (59%) said they were not considering an OPM.

Figure 1.

This reflects the trend toward strengthening in-house capacity, building core competencies in online learning and turning to selective fee-for-service outsourcing only when needed—a reaction (in part) to the negative perceptions that have dogged the “OPM” label.

One could expect this market to fade if institutions slowed their plans for online growth. Yet new data from CHLOE 10 shows that nearly half of COLOs plan to launch between one and four new online programs in the next three years. In total, 88% of leaders expect to add programs.

Online leaders report that program growth is most often driven by online enrollment goals, but growing online enrollment can be challenging in the current environment, especially for leaders with limited resources. This points to a need for a strategic partner.

But leaders are torn: Use an OPM and face internal political fall-out or try to grow online programs and enrollment with insufficient resources.

The “OPM” Brand Problem

With the OPM industry regrouping, now is a good time to reevaluate this market and perhaps even the descriptor “Online Program Management,” which has become toxic in many higher education circles. Today, companies go out of their way to avoid the term. Some say, “online program enablement,” and HolonIQ once tried the broader “OPX” label referring to “the entire spectrum of services models supporting universities in the design, development, and delivery of online higher education.”

There is a strong case for reframing this market. Perhaps a broader categorization of Digital Program Enablement would fit the bill. “Digital” reflects the multimodal reality that students and institutions now experience, whereas “online” is confined to one end of the modality spectrum. And “enablement” emphasizes collaboration—augmenting and supporting current staff and faculty with additional expertise, personnel, or technology— countering the outsourcing impression left by “management.” Institutions still need to identify gaps and strategically outsource services and technology, but enabling an institution should be a core goal of a partnership.

Some “OPM” companies—like Human Capital Education (formerly Elsmere) and EducationDynamics—are ramping up research capabilities. Others, such as Archer Education, Collegis Education, and iDesign are promoting the benefits of leaving OPM partnerships while offering a similar set of services and technologies. Some of these companies did not fit neatly under the historic “OPM” label. “Digital Program Enablement” could be a more inclusive way of understanding companies that support digital strategy.

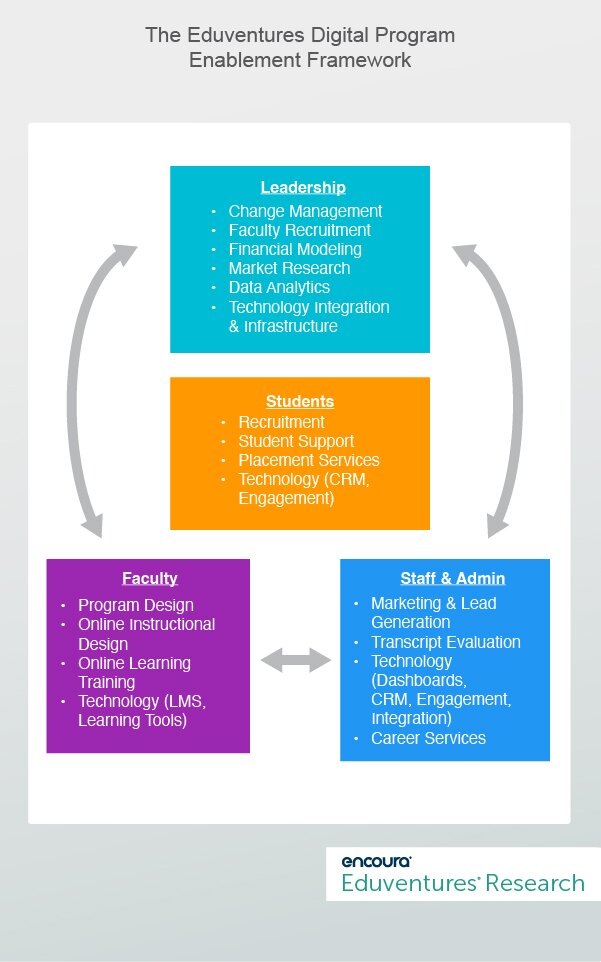

Often, OPMs are categorized by the services they provide or the business models they offer rather than by whom they support within an institution. The framework in Figure 2 takes a human-centered approach to thinking about these partnerships. It shows how these companies can support four main stakeholders—institutional leadership, staff and administrators, faculty—with students at the center (see Figure 2).

Figure 2.

Figure 2 illustrates how three institutional stakeholder groups are interconnected, each with distinct but often overlapping services and technologies that support digital programming. In the middle are students, since all work flows to benefit them. Inside each stakeholder box is an illustrative (though not comprehensive) list of services and technologies providing support to each group.

One stakeholder not represented in the framework is employers. As discussed earlier, some companies are increasingly catering to this group, given higher education’s dual role in preparing new employees and upskilling the existing workforce.

This framework acknowledges that these OPM and OPM-adjacent companies are rarely just enrollment partners. For institutions, this means rethinking not only who they partner with but how they add value to digital program offerings.

The Bottom Line

“OPM” once implied a specific business model, service mix, or company origin. The long-standing recipe of bundling recruitment, marketing, and other services in a revenue-share model, while still popular with a shrinking minority of institutions, is no longer sufficiently descriptive of how these companies have evolved. The “Digital Program Enablement” terminology might not catch on, but the framework offers a more accurate and flexible lens.

Today, it’s about enabling digital capacity across the institution by supporting students and faculty, leveraging data and technology, and engaging employers. That broader scope, stepping back from business-model and bundling debates, raises the stakes and the opportunity.

As leaders aim to grow enrollment amid tightening budgets and intensifying competition, and they weigh the possibilities of partnership, they should ask some fundamental questions: How can this company support my staff, faculty, and students? And how can this company enable our institutional digital strategy?