Every year I stick my neck out and make some higher education predictions, and 12 months later I review how I did.

My concern three things that are top-of-mind for many higher education leaders: where the U.S. economy is headed, the certificate boom, and the trajectories of coding bootcamps and computer science master’s degrees.

Helpfully for our readers, but riskily for me, my 2020 predictions will be straightforward to prove or refute; they either clearly will or will not happen. At the end of the year, I will not be able to reel off a few half-relevant anecdotes and claim that I kinda sorta was right after all…

Prediction 1: No Recession in 2020 (Adult Learners Say So)

One reason why total U.S. higher education enrollment has been in decline for close to a decade is that the country is enjoying the longest period of uninterrupted economic growth in its history—126 months and counting.

As every enrollment leader knows, higher education enrollment is counter-cyclical: when the economy is weak, enrollment goes up. For schools struggling with recruitment, another recession might seem like welcome relief. The rub is that no one knows when the next recession will hit.

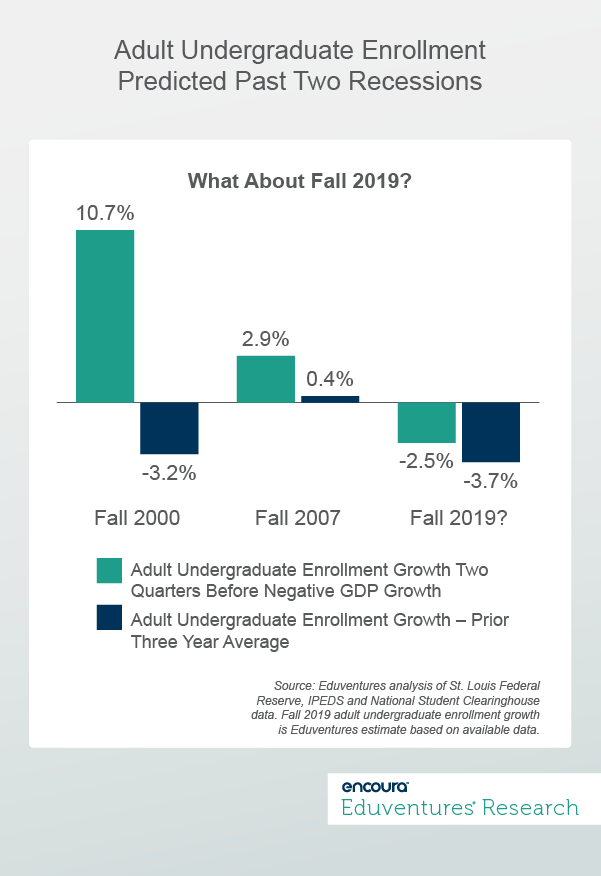

But what if higher education enrollment predicted recessions? Evidence from the recessions of 2000-01 and 2007-09 suggests that adult undergraduate enrollment, most sensitive to the economy, predicted both downturns (Figure 1).

Figure 1.

In 2000 and 2007, two quarters before the first decline in U.S. GDP, adult undergraduate enrollment spiked. The trend was most obvious in fall 2000 when adult undergraduates jumped 10% in a single year, no doubt spooked by the dotcom crash that spring. Red flags were perhaps less obvious in 2007; but nonetheless, economic friction showed up in adult undergraduate enrollment growth 10 times the prior three-year average.

So, what does fall 2019 portend?

The evidence is mixed. On the one hand, adult undergraduate enrollment improved a bit to an estimated -2.5% year-over-year in 2019, stronger than the average -3.7% decline over the prior three years. This may point to stirrings of economic stress. But the fact stands that enrollment remains negative, and recent quarterly GDP growth has been respectable and stable, and job creation still robust.

So…. my prediction is that there will NOT be a recession in 2020.

Prediction 2: In 2020, Graduate Certificate Growth will Again Outpace Master’s, but a Yawning Data Gap will Remain

The certificate question—whether short, inexpensive programs are eroding the master’s market, or at least the master’s market for less prestigious schools—is on the minds of many of our clients. In a previous Wake-Up Call, we weighed the evidence. (Of course, the certificate market is much bigger at the undergraduate level, but that’s another story.)

Data recently released by the U.S. Department of Education suggest that certificate boosters are on to something. In 2018, as shown in Figure 2, the number of graduate certificates awarded jumped by 11% over the prior year, compared to a 2% improvement for master’s. That is the biggest graduate certificate gain in at least a decade.

Table 1. The Case for Certificates … is Not Clear-Cut

| Credential | Five-Year Completion Growth (2018 vs. 2013) | One-Year Completion Growth (2018 vs. 2017) | Number of Completions (2018) | Average Completions per Program (2018) |

|---|---|---|---|---|

| Graduate Certificate | 33% | 11% | 71,000 | 6 |

| Master’s Degree | 9% | 2% | 827,000 | 21 |

Source: Eduventures analysis of IPEDS data.

The certificate prospectus looks great on the left side of Figure 2, but not so great on the right. Yes, graduate certificates are a fast-growing market, but also a small and inefficient one. It is hard to conclude that master’s programs are under serious threat.

But what if the real action is elsewhere?

Take two prominent purveyors of short graduate-level programs: GetSmarter, part of 2U, and Emeritus. These firms partner with leading universities around the world, including many from the United States. GetSmarter reports over 32,000 “full course equivalent enrollments,” which 2U informed Eduventures is a good proxy for the number of unique students. Emeritus recently went on record as enrolling 30,000 students. Both providers cite rapid growth.

Yet, the U.S. university partners of these two companies, which include the likes of Harvard, Stanford, Yale, MIT, and Dartmouth, often make little or no impression on the federal graduate certificate data, and even less in the fields—typically business, IT, and healthcare—that constitute their GetSmarter and/or Emeritus alliances.

Emeritus asserts that 70% of its students are based outside the U.S., yet federal data says that only 9% of graduate certificate completers in 2018 were international.

There are several possible reasons for the discrepancy: many of the certificates and the like offered through partner firms may be treated as noncredit, and therefore fall outside federal jurisdiction. For some schools, there may be a time lag between program launch and completion volume. Perhaps non-U.S. partner universities account for an outsized share of GetSmarter and Emeritus enrollment.

But one thing is clear: relying solely on federal graduate certificate data to understand the certificate question risks missing a lot of the action.

My prediction for 2020 is that federal graduate certificate completion growth will once again leave master’s programs in the shade, posting another double-digit year, but that will only hint at the true dynamism of this market. “Certificate” enrollment is bigger than it first appears, and it would be a mistake to assume that conventional for-credit programs are the only currency that matters. Master’s programs can still look down on their shorter brethren but should also look behind them.

Prediction 3: In 2020, Decisively, Coding Bootcamp Graduates will Outnumber Domestic Master’s Degrees Awarded in Computer Science

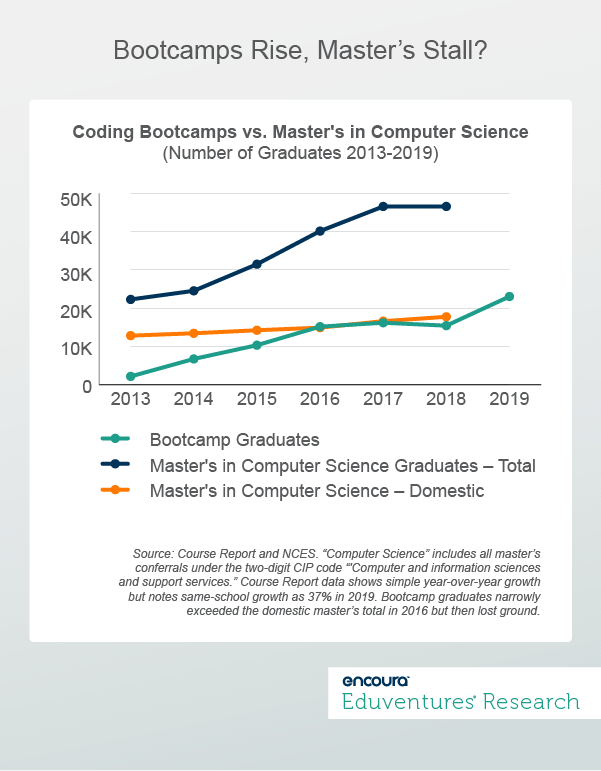

Coding bootcamps, the educational innovation that arose over the past decade to tackle an acute supply-demand crunch in computer science, had a stellar year in 2019. Dismissed as a fad by some, in 2019, bootcamps graduated 23,000 people, up 49% in one year (37% on a same-school basis).

Like certificates, coding bootcamps compete with (and complement) both bachelor’s and master’s degrees, but my focus here is the latter. Figure 3 contrasts bootcamp graduates with the performance of master’s degrees in computer science.

Figure 3.

In 2017, total computer science master’s degrees were in the ascendant, while bootcamps stalled. But then years of rocketing master’s growth suddenly came to a screeching halt, and in 2019, bootcamps soared.

But not so fast. International students make up the majority of computer science master’s students. The Trump-era climate and renewed competition from other countries has pushed overall new international enrollment in the U.S. into reverse. If just domestic computer science master’s trends are considered, 2018 saw a 7% completion increase. But short of an unprecedented surge in domestic master’s degrees awarded in 2019, that year will mark the turning point when bootcamps—dominated by U.S. students— unequivocally passed master’s degrees.

Other notes of caution are needed. Some colleges and universities posted healthy master’s completion growth in 2018. Among the 10 largest players, a number focused on the domestic market, such as Georgia Tech’s low-priced computer science master’s. The average domestic conferral growth that year was nearly 113 students. But for the other 500-odd schools, the average gain was less than one student.

Other sources back up the idea of a domestic slowdown. The Council for Graduate Schools reported a 0.5% decline in part-time new computer science graduate enrollment in 2018.

Bootcamps not only serve college graduates eligible for master’s programs. But it is fair to say that the recent college graduate, bachelor’s in hand, is a major target for bootcamps. Indeed, a growing number of universities offer their own bootcamps , to their undergraduates, often in partnership with firms like Revature and Trilogy. (Such bootcamps are excluded from the Course Report tally meaning the true size of the bootcamp market is understated).

A master’s degree in computer science is likely to cover a wider range of topics than a six-month bootcamp, but the bootcamp boom raises a question: except for those going down the doctorate and faculty path, is a few months of intensive training a better fit, and better value, than a degree for many students?

Revived bootcamp fortunes in 2019, based on 93% of U.S. bootcamps responding to the Course Report survey, suggests an industry that has found its feet after years of business model refinement and provider churn. Voluntary regulation is now established, notably the Council on Integrity in Results Reporting (CIRR), and financial aid arrangements have stabilized. The industry is taking equity issues seriously. In these respects, bootcamps are emulating universities.

One year does not a trend make. Mixed fortunes at the master’s level may in part reflect the challenge of recruiting enough computer science faculty, aided by falling international student numbers. Today’s bootcamps still have much to prove when it comes to the career trajectory of graduates. One thing few bootcamps disclose, and a topic on which CIRR is silent, is what proportion of bootcamp students actually graduate.

I predict that in 2020 coding bootcamp graduates will grow double-digits once again, and federal data will confirm that in 2019, bootcamp graduates unequivocally passed total master’s conferrals. Quite a milestone for a “fad.”

2U’s purchase of Trilogy, and Thinkful becoming part of Chegg, both in 2019, signal serious interest in bootcamps. Meanwhile, driven by international student shortfalls, total master’s conferrals in computer science will decline for the first time since dotcom disillusionment swept the field over a decade ago.

An intriguing question is: what impact does a university's own bootcamp have on domestic enrollment in its computer science master’s program: complementary or competitive? That will have to wait for another Wake-Up Call.

Editor's note: This post was updated to include revised enrollment numbers provided by GetSmarter.

Eduventures Chief Research Officer at ACT | NRCCUA

Contact

Thursday, January 16, 2020 at 2PM ET/1PM CT

For many years, transfer students were an afterthought at most institutions. Transfer applications – often the first point of contact with these students – would reliably find their way to the admissions office. Today, however, many schools report declining transfer enrollment, lower graduations at feeder schools, and increasing competition for these students.

New Eduventures® research – released in the Annual Eduventures Transfer Student Research™ Report – examines the transfer student landscape and provides insight into the recruitment process from the students’ perspectives. In this webinar, you’ll learn about prospective transfer students’ priorities, college search resources, and concerns.