For months, headlines about funding cuts and visa revocations have cautioned institutions to brace for declines in international enrollment. While the outlook for campus-based international students feels increasingly uncertain, some schools are turning their attentions to a different opportunity: fully online international enrollment.

Historically, international students enrolled in online programs have prioritized a combination of high brand reputation and low tuition—ala Georgia Tech’s suite of technology master’s degrees. But there are signs that this formula may be shifting.

Is it time for institutions beyond the top-tier national brands to investigate this opportunity?

Online International Market Evolution

In 2010, international students enrolling in online programs was out of the question. Recall that about a decade ago, Georgia Tech launched its Online Master’s in Computer Science (2014) program, and University of Illinois Urbana-Champaign (UIUC) launched its Master’s in Data Science and iMBA programs (2016). These programs created a “blueprint” that many institutions have tried to replicate.

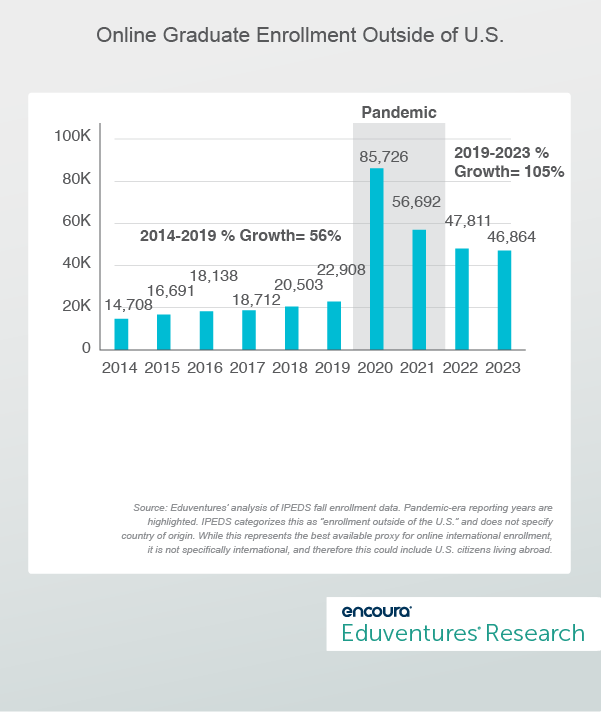

According to IPEDS, the number of graduate students enrolled “outside of the U.S.” grew 56% between 2014 and 2019 (from 14,708 to 22,908) and doubled during the pandemic years (from 23,000 in 2019 to 47,000 in 2023). But despite strong growth, this market represents only 3.7% of the total online graduate market, making it small but emerging.

Figure 1 shows the online graduate enrollment from outside the U.S. between 2014 and 2023.

Figure 1

In 2023, Georgia Tech enrolled over 7,000 of these students—accounting for 15% of the total, while UIUC enrolled just under 1,000 students in fall 2023—the fifth most. So, the historical blueprint for large online international enrollment appears to include the following elements:

- Start with a national brand

- Offer technology and business graduate programs

- Offer a lower price point

- Use an Online Program Management (OPM) company to achieve growth

- Be in the market for a decade

But this blueprint is challenging to recreate. Coursera, one OPM that has thrived in this market, reported 26,700 “Degrees Students” in the fourth quarter of its fiscal year 2024 (total students, but with a significant international portion). Growth was attributed to recently added programs in India. But Coursera has been selective with its institutional partners and programs (in its own words) and is now prioritizing growth in other segments.

What are institutions left to do? Attempting to do this without a partner is daunting, especially marketing to international students due to the complexity and context needed to understand a single country, let alone multiple countries.

A New Blueprint?

Some institutions, such as American University, are partnering with international OPM companies to find a new blueprint. American University has partnered with Skilled Education, a U.K.-based OPM, to expand its largely conventional online graduate programs “to reach international students across the globe.”

Let’s look at a couple of other examples:

Northern Arizona University (NAU)

The third largest public institution in Arizona, NAU, is going up against heavyweight online players, including Arizona State University (ASU), University of Arizona Global, Grand Canyon University, and University of Phoenix. How can NAU possibly compete with these online giants?

To grow enrollment, NAU partnered with Beacon Education—a Chinese company—on three master’s programs that were brought to the Chinese market after translation (therefore skipping TOEFL requirements) and built using a “competency-based format.” This allows students to complete a degree in as little as 12 months (or two six-month subscriptions). Students can start a subscription on the first Wednesday of every month.

While it is unclear what the program costs, one program—a Master’s of Computer Information Technology—enrolled 863 students in fall 2024. In November of 2024, it announced 1,000 graduates of the program. Beacon Education works with about 10 other U.S. institutions on programs primarily in business and technology.

Golden Gate University (GGU)

Located in San Francisco, Golden Gate University has served working professionals since its inception. In 2022, it announced GGU Worldwide—an initiative designed to increase accessibility and affordability across the world. It partnered with UpGrad, an Indian company that brings international institutions to that market. With this partnership GGU offers certificates, master’s, and doctoral business programs—with some programs offering a 70% scholarship to those outside the U.S.—making the MBA as little as $10,000.

Most notably, this online MBA has an optional campus immersion in San Francisco and alternatively, it can transition to a study abroad program where students finish the program on campus. While it is hard to pin down GGU enrollment, we estimate that across its graduate portfolio at least 600 students are enrolled outside of the U.S., suggesting a successful outcome.

The Bottom Line

These case studies highlight that some parts of the online international “blueprint” remain sticky—these students continue to prioritize technology and business programs, for example. And while cost is a key consideration for all online students, due to exchange rates and market conditions, it holds even greater significance for online international students.

But these example institutions have grown enrollment with partner programs in a matter of years without reliance on a national brand presence. This suggests that while international students prize national brand reputation, there is a market for online international students that evaluates brand as one among many factors.

Institutions considering greater investment in the international online market should consider a few additional factors:

- If you translate curriculum into another language, how will institutions monitor program outcomes?

- If the program has a study abroad option, can your institution facilitate and handle the growth and support that on-campus international students require?

- How do you choose the right partner to navigate recruitment, regulation, and student support across borders?

The online international market may still be small, but it is evolving and could be ripe for new entrants. For institutions willing to try a new blueprint, this could be an opportunity.

Understand Students’ Desires With Prospective Student Brand Research

Drive your communication strategy and influence your brand reputation with research that reveals prospective students’ perceptions and desired college experiences.