Ten years ago, MOOC-era platform companies like Coursera, edX (part of 2U), and Udemy looked set to change online higher education forever. Today they boast low-cost degree and non-degree programs, partnerships with the best-known universities and companies on the planet, and hundreds of millions of learners (boosted further by the pandemic).

A 2023 Eduventures report acknowledged their achievements but sounded a note of caution, citing low conversion rates, modest revenue-per-student, lack of profits, and a limited student experience.

One year on, how are these big three platform companies doing, and what does that tell us about the non-degree and low-cost online degree markets?

The Non-Degree Market

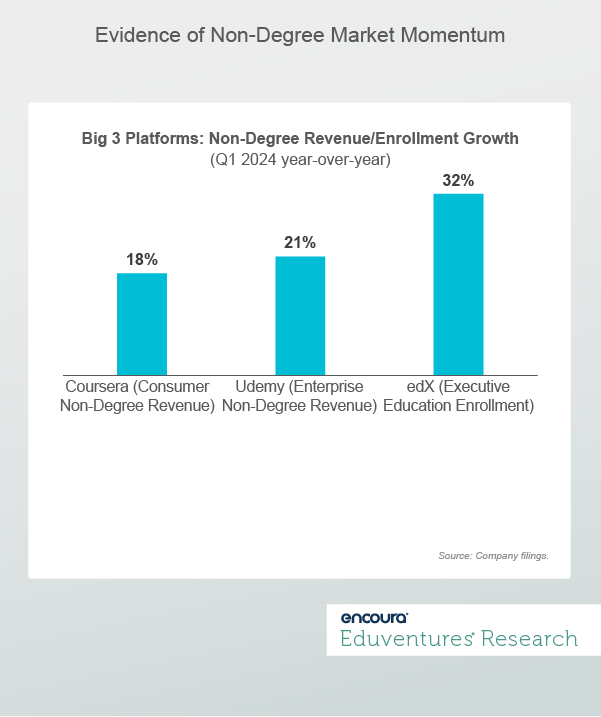

The three companies recently reported their Q1 2024 results. Coursera and Udemy posted healthy year-over-year revenue growth, both driven by non-degree momentum (Figure 1).

Figure 1.

These are good numbers, but some qualifications are needed:

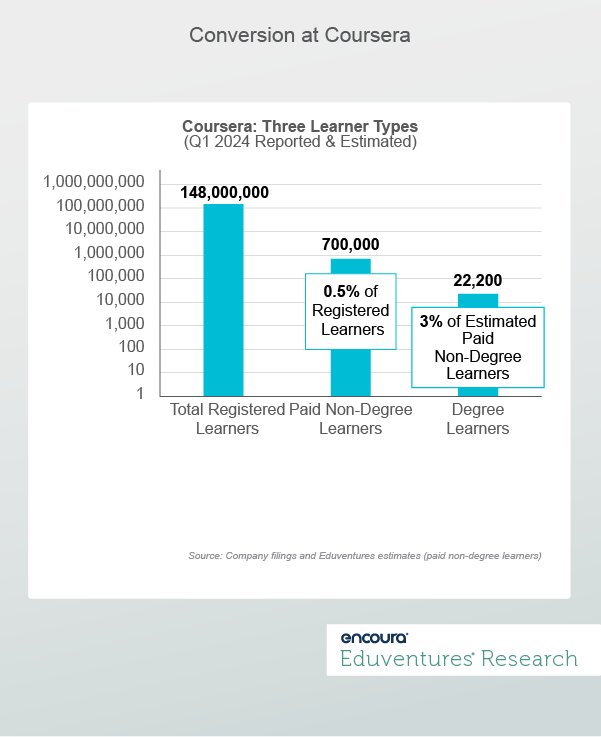

- Coursera, in recent quarters, has posted faster consumer non-degree revenue than learner growth, suggesting success at boosting revenue-per-learner. With 148 million registered learners, however, revenue-per-learner remains miniscule: about $1.50. Most “registered” learners pay nothing, but the company does not report how many do pay. In our 2023 report, Eduventures estimated a mean revenue-per-(paying)-learner of $500, implying about 700,000 paying learners annually (0.5% of the total). This is still a big number—equivalent to about a fifth of U.S. graduate enrollment—but far from headline figures.

- Udemy focuses on corporate clients, now claiming over 16,000 enterprise customers globally, bringing in about $400 million a year—about $25,000 per client. B2B revenue grew faster than the enterprise client total, perhaps pointing to deepening use by existing customers. Udemy’s B2C learner total—paid or unpaid—is not reported, but generates less revenue than B2B, and such revenue dipped in the most recent quarter.

- edX (2U) saw total non-degree revenue fall (attributed to a slump in the bootcamp business). A bright spot was an $11 million revenue increase for executive education, fueled by the 32% increase in executive education enrollment. The company does not report total executive education revenue. edX does not break out B2B versus B2C non-degree learners or revenue.

Which partners are generating revenue for the Big Three platforms?

Companies, not universities, are in non-degree pole position on the Coursera site. The homepage highlights eight fast-growing occupations—from Data Analyst to UX Designer—but advertises only “professional certificates” from partner companies such as Google and Meta, and none from partner universities (even though many relevant university programs are in the Coursera catalog).

The edX homepage, by contrast, leads with university partners, even for A.I. and Data Science (but also includes corporate courses among its offerings). Leading universities dominate edX’s executive education portfolio.

At Coursera, the consumer business remains larger and grew faster than B2B, while the opposite is true for Udemy. This suggests that Coursera’s university-heavy catalog may resonate better with consumers than with companies, while Udemy—which does not work with universities and does not offer degrees—may experience the opposite. Yet, Coursera’s emphasis on its corporate program partners appears to be key to growing its non-degree B2C business. Coursera’s still university-centric partner list (compared to Udemy’s) may also explain Coursera’s moderating B2B growth.

Annual revenue this year is expected to be in the $700-800 million range for each company. At Coursera and Udemy, most or all revenue is non-degree, compared to about a quarter at edX . This suggests that high-tens or low-hundreds of millions of dollars are flowing to university partners for non-degree programs on Coursera and edX. But each platform has hundreds of university partners and thousands of programs, so per-program returns may be less impressive.

The unknown—for Coursera and edX—is what share of non-degree revenue is going to university—as opposed to corporate—programs, and which universities and programs perform best. Non-technology and non-business offerings are much less prominent than pre-pandemic.

Low-Cost Degrees

Degrees are strategic for Coursera and edX. The theory is that some learners will start with free courses, transition to paid non-degree programs, and then ladder to a degree.

Coursera currently offers 12 bachelor’s degrees and 43 master’s degrees. Examples include a Master of Applied Data Science from University of Michigan, a Master of Science in Computer Science from University of Colorado Boulder, and a Bachelor of Science in Business from University of North Texas. Most programs are in these sorts of fields and a growing number are from international institutions.

In the first quarter, Coursera reported 22,200 degree learners, up 23% from a year ago. That is an average of 400 learners per degree. Degree learners earned Coursera $15 million in revenue, about 9% of the company total. Modeling to annual revenue and including the revenue earned by institutions suggests estimated revenue-per-learner of about $9,000.

If Eduventures’ estimate of 700,000 paid non-degree learners is accurate, it implies that only 1-2% of non-degree learners transition to degrees (if a portion of degree learners enroll directly).

Figure 2 uses a logarithmic scale to show Coursera’s registered learners and estimated paid non-degree and degree learners.

Figure 2.

Degree enrollment at Coursera grew faster than degree revenue, suggesting that—despite often low prices—discounting is needed to drive recruitment. It is not known what proportion of degree learners on Coursera are based in the United States. (In a recent learner survey by the company, only 13% of respondents were from the U.S.).

edX does not break out its conventionally priced online degrees from the more inexpensive ones offered through edX. Total degree revenue was down—due to the company exiting certain contracts—and there is no indication that low-cost degrees are bucking the trend.

The Bottom Line

The three learning platform companies continue to make progress. None have yet turned a profit but are edging closer. Marketing spend is moderating and revenue-per-learner (at least for non-degree programs) is climbing. Student outcomes—if self-reported by companies—look good.

But online flexibility and low prices are double-edged, keeping revenue-per-learner low and constraining the student experience. The companies are striving to better support learners, by adding A.I.-powered agents (e.g., edX’s Xpert assistant) and smoothing career paths (e.g., Coursera enables learners to display a “Skill Profile”). Time will tell whether such automation or self-service proves compelling enough to push enrollment and retention to another level.

The stock market is skeptical: Coursera and Udemy are trading at $7-8 a share (both far from their peaks), and 2U (edX) languished below $1 before a recent stock split designed to avoid delisting. 2U labors under weighty debts (close to $900 million, used most recently to purchase edX).

An economic downturn—something none of these firms has experienced outside the pandemic—could be a game-changer, driving more learners onto the platforms. Immersive, A.I.-powered learning—transforming the student experience—still seems far off.

Some standout programs (e.g., University of Illinois’s iMBA on Coursera) have thrived, enrolling thousands of students. But such examples are few, and stellar university non-degree programs appear rarer still. A general program in a global shop window has its advantages, but so does the intimacy of a regionalized, hybrid alternative, which many schools not on these big platforms may use to differentiate themselves as the online market gets more crowded.

In terms of consumer sentiment, instructional innovation, and emerging competition, the next few years will be decisive for Coursera, edX, and Udemy.