Our country’s least selective public and private institutions enroll most of our traditional undergraduates (72%). They also face the greatest enrollment challenges. The FAFSA disruption, campus political unrest, demographic decline, and shifts in the value proposition of college post-COVID are influences blowing them—and nearly all institutions — off course.

With the “enrollment cliff” looming, it is more important than ever to stand out in the market by building a stronger brand—especially among least selective institutions. Which brand constructs are most attractive to students now? How will this influence your strategy for weathering the changing market?

Contours of the Undergraduate Market

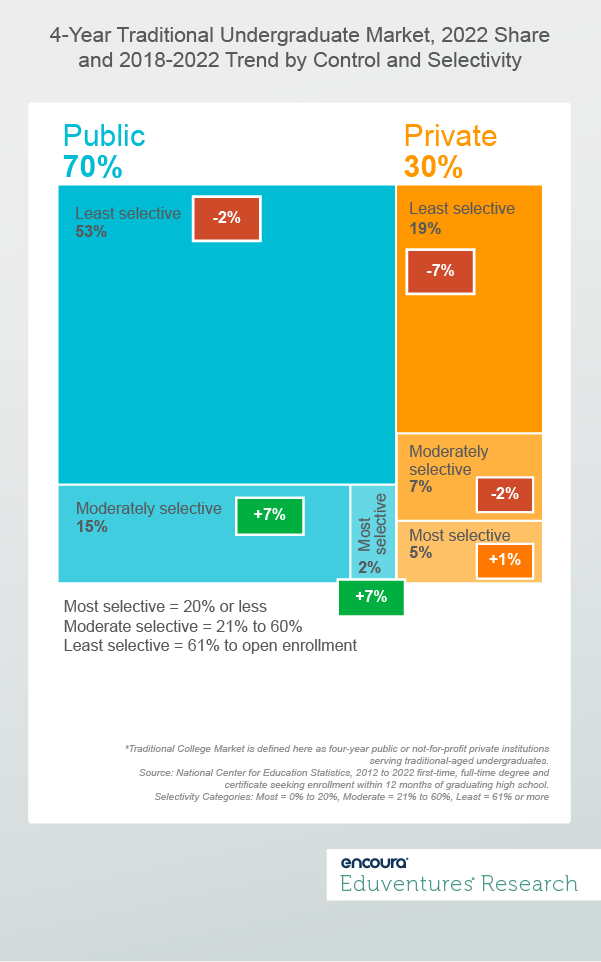

Before we get into brand, let’s break the traditional college market* into six major segments based on control and selectivity. Figure 1 shows the market share and 10-year enrollment trend for each segment, answering two questions: Is the segment sizeable? And, is the segment losing or gaining enrollment?

Figure 1.

Enrollment Momentum Is in the Moderate to Most Selective Publics

As Figure 1 shows, most students in the U.S. attend public institutions (70%) and less than a third attend a not-for-profit private institution (30%). About half of all students attend a least selective public (53%)—an important sector that has experienced declining enrollment between 2018 and 2022 (-2%).

Least selective private institutions—enrolling almost a fifth of all students (19%)—have experienced the largest decline (-7%). Many of these institutions are under immediate existential threat, even before we go over the “demographic cliff.” These institutions are facing headwinds on value—in other words, they cost too much for the outcomes they deliver.

The growth story in traditional undergraduate education is in the moderately and more selective publics, enrolling 15% and 2% of all students and growing 6% and 7%, respectively. Yet the national conversation is often about the most selective privates, enrolling only 5% of all students and (very) slowly growing enrollment.

Each of these sectors is associated with key brand constructs that drive student interest. The question is, what about these growth sectors is capturing the imagination of students?

Brand Perceptions Differ Among Institutional Market Segments

At this inflection point, from overall growth to overall decline across key market segments, it is more important than ever to understand what brand drivers appeal to today’s students. Each institution should understand the market segment for not only what drives student interest in their institution, but also what drives students toward their competitors—and competition is about to become more important than ever.

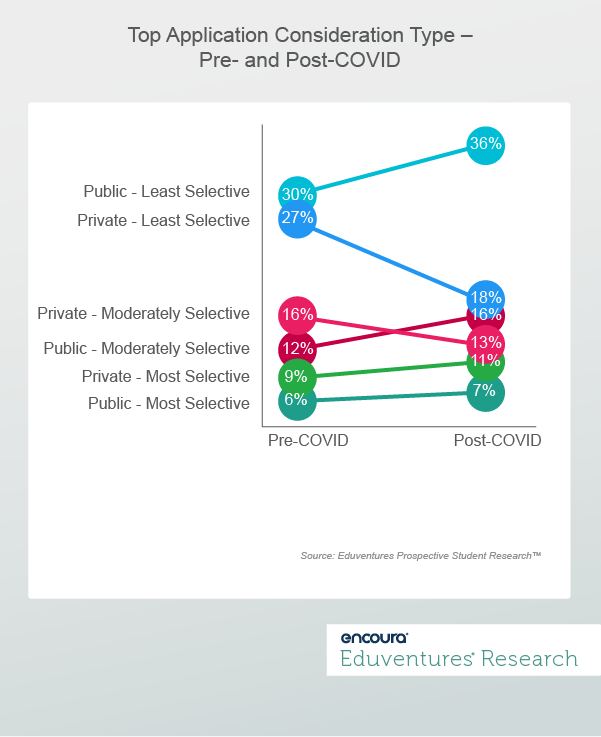

Figure 2 shows the most straightforward indicator of brand strength in the undergraduate market: whether or not the institution is a top choice at the time of application (top-of-the-funnel demand).

Figure 2.

Figure 2 shows that the segment that has already experienced the most severe enrollment decline (least selective privates) is also experiencing rapid decline in top-of-the-funnel demand (-9%). All publics and the most selective privates are seeing increases in top-of-the-funnel demand.

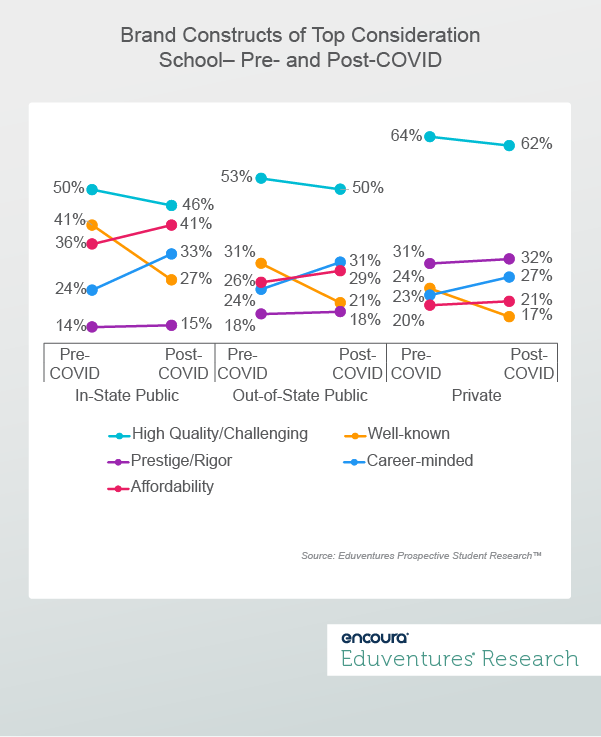

What are students looking for in their top application considerations? Figure 3 below shows the change in key brand constructs pre- to post-COVID for students interested in attending private and public institutions (in-state and out-of-state).

Figure 3.

Figure 3 indicates that the most important brand construct to demonstrate to all students is “high quality/challenging.” It has decreased in importance only slightly over the course of the pandemic. Another critical brand construct that is substantially on the rise for every institution is “career-minded.”

These two constructs (“high quality/challenging” and “career-minded”) reflect students’ desires for an internal locus of control: “I control my own destiny by challenging myself with quality academic programs. I develop a career pathway in partnership with an institution.”

Figure 3 also shows that being “well-known” is a far less prominent brand construct post-COVID. Likewise, the “prestige/rigor” brand construct—now on par with “career-minded”—is relatively less important for students interested in public institutions, though more prominent for private institutions.

These two constructs (“well-known” and “prestige/rigor”) are focused on an external locus of control: “Others control my destiny. The brand recognition and reputation of an institution will open doors for me.”

Overall, this data suggests that students are increasingly opting for institutions where they feel they are in partnership to achieve success.

The Bottom Line: Put the Emphasis on Quality Outcomes More Than Reputation

Focusing on partnering with students to help them succeed will build brand health. Here’s what to consider as you develop your market position.

- “Quality” and “challenge” are top-most in students’ minds. Emphasize how your academic and experiential opportunities can help students learn and grow. For example, instead of highlighting superstar alumni who might intimidate or discourage students, highlight young alumni who have achieved early life and career success by following a pathway that suited their personal goals.

- In almost all instances, “rigor” and “reputation” should play a supporting role. Some students care about name recognition and rankings, but most don't. That matters more for parents. When you talk about rankings, rigor, and reputation, link these external views with the quality that earned your institution’s reputation. For parents, it might be better to begin with reputation. For students, it might be better to end with reputation.

- Use Eduventures’ Prospective Student Mindsets™ to tell your story better. This is especially true for institutional narratives on quality, challenge, and outcomes for each type of student in your funnel. Mindsets tell you what goals students have and what experiences they think will help them reach those goals. Your stories should show clearly how alumni achieved success.

As the market for conventional-aged undergraduates continues to shrink, you need to align your brand with what students want. This generation of students want agency. They want to find an institution that will partner with them to find a path to success.